Regardless of the U.S. economy’s close to miss with a downturn a year ago and a progressing Covid pandemic that has brought travel to a virtual stop, Jeff Hurst, the CEO of get-away rental firm VRBO, sees a blast not too far off.

“Each house will be taken this summer,” Hurst said, as the normal insurance from immunizations shows up in sync with hotter climate, releasing a cooped-up populace with record reserve funds buried. “There’s such a lot of developed interest for it.”

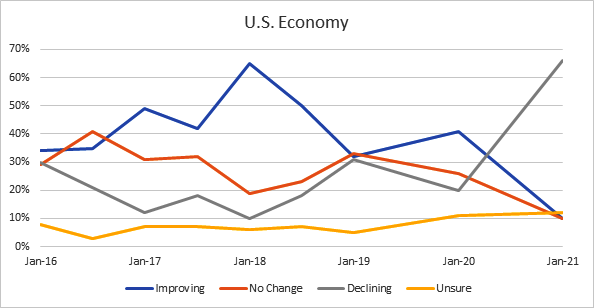

Such a bullish conclusion has progressively flourished among chief executives, experts and customers who see the previous year of similar hibernation – from the public authority requested business closings the previous spring to hazard evasion by the general population – offering path to a mindful reappearance and green shoots in the economy.

Graphic: Retail in real time

Information from AirDNA, a momentary rental investigation firm, showed excursion appointments tmsnrt.rs/3uxQ1Wi for the finish of Spring, which generally matches with school spring breaks, are only 2% beneath their pre-pandemic level. Business openings on place of work undoubtedly are 4% over a pre-pandemic benchmark. Information on retail pedestrian activity, air travel and situated burger joints at eateries have all edged up.

Also, business analysts’ estimates have risen as once huge mob, with firms like Oxford Financial aspects seeing a “squeezed up” economy hitting 7% development this year, more than average of an agricultural nation.

Graphic: A historic lifeline –

In a representative achievement, Significant Class Ball clubs took to the field on Sunday, as planned, for the primary rounds of the spring preparing season. Groups were needed to notice social removing rules and restricted to around 20% of limit, however MLB has a full timetable penciled in after a shortened 2020 season that didn’t start until July and saw groups playing in void arenas.

Graphic: Oxford Economics Recovery Index

Misery Evaded

As of Feb. 25, around 46 million individuals in the US had gotten in any event their first portion of a Coronavirus antibody – still under 15% of the populace and adequately not to hose the spread of an infection that has executed the greater part 1,000,000 individuals in the nation, as per the U.S. Communities for Infectious prevention and Anticipation.

The rise of Covid variations presents chances, and a getting back to typical life before invulnerability is far and wide could give the infection a new traction.

Nor is idealism worldwide. The European transient rental market, for instance, is enduring, with a huge number of Airbnb contributions pulled. Up to one-fifth of the inventory has vanished in urban areas like Lisbon and Berlin, as proprietors and administrators conform to a rough antibody rollout and questions about the resumption of cross-line travel.

In the US, the antibody rollout and a sharp decrease in new cases has delivered a monetary standpoint unfathomable a year prior when the Central bank opened its crisis playbook in a concise guarantee of activity and Congress affirmed the first of a few salvage endeavors.

Graphic: The third wave breaks –

The dread at that point was long periods of hindered yield like the Incomparable Wretchedness of the 1930s, while a few projections anticipated huge number of deaths and an all-inclusive public isolation. All things considered, the main antibodies were circulated before the finish of 2020, and a record financial and money related intercession prompted an ascent in close to home livelihoods, something unbelievable in a downturn.

“We are not experiencing the drawback case we were so worried about the primary portion of the year,” Took care of Seat Jerome Powell told administrators on Wednesday. “We have a possibility of returning to a greatly improved spot in the second 50% of this current year.”

‘ROCK ON’

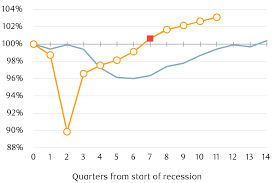

U.S. GDP, the broadest proportion of financial yield, may top its pre-pandemic level this summer, moving toward the “Angular” bounce back that appeared to be unreasonable half a month prior.

That would in any case mean over a time of lost development, yet by and by addresses a recuperation twice as quick as the bounce back from the 2007-2009 downturn.

Occupations have not followed as quick. The economy stays around 10 million positions shy of where it was in February 2020, and that opening remaining parts a squeezing issue for policymakers close by getting schools and public administrations completely returned.

It required six years after the last downturn to arrive at the earlier work top, a cold interaction authorities urgently need to abbreviate.

While ongoing months have seen little improvement, the viewpoint might be improving. Treasury Secretary Janet Yellen said in mid-February the nation had a battling opportunity to arrive at full work one year from now.

It might take more than antibodies, nonetheless. Authorities are discussing how completely and for all time to revamp the principles of emergency reaction – and explicitly how much and what components of the Biden organization’s proposed $1.9 trillion salvage intend to affirm.

Monetary pioneers a year ago cast aside numerous old symbols, including trepidation of public obligation and a distraction with “moral danger” – the terrible motivations that liberal public advantages or corporate bailouts can make. For conservatives, that implied favoring starting joblessness protection benefits that frequently surpassed a laid-off specialist’s compensation; for liberals, it implied helping aircrafts and briefly loosening up financial guidelines.

It worked, thus well that an odd consortium of cynics has arisen to address the amount more is vital: conservatives contending help ought to be pointed distinctly at those out of luck, and a few leftists stressing that quite a lot more government spending in an economy prepared to quicken may start expansion or issues in monetary business sectors.

In the event that the standpoint is improving, nonetheless, it’s in expectation that administration backing will proceed at levels sufficient to complete the work.

“Rock on,” Bank of America experts wrote in a Feb. 22 note boosting their entire year Gross domestic product development gauge to 6.5%, a result started on endorsement of $1.7 trillion in extra government alleviation, “unambiguously certain” health news, and more grounded buyer information. Given all that, “we anticipate that the economy should quicken further in the spring and truly spring up in the late spring.”

What’s more, the view back at VRBO? In most prime places to get-away, Hurst said, “You will not have the option to locate a home.”