CoreWeave, a specialized cloud provider, announced on Thursday that it had received $2.3 billion in a loan facility headed by Magnetar Capital and Blackstone and collateralized by Nvidia chips. The money would be used to expand to handle the growing demand for AI workload.

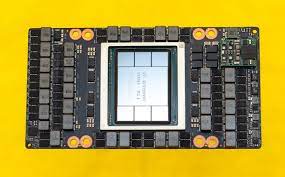

Coatue and DigitalBridge, in addition to BlackRock, PIMCO, and Carlyle, are additional lenders in the arrangement. The unprecedented use of the sought-after Nvidia H100 processor, which supports AI computation, as collateral emphasizes the importance of such equipment in the expensive AI arms race.

As private equity companies shift to lower-risk loans secured by tangible assets and take on more corporate debt when banks slow down, the size of the loan also symbolizes the expanding market for private asset-based finance.

According to Michael Intrator, CEO of CoreWeave, “We negotiated with them to find a schedule for how much collateral to put into it, what the depreciation schedule was going to be versus the payoff schedule.” “For us to go out and borrow money against the asset base is a very cost-effective way to access the debt markets.”

Nvidia-backed CoreWeave has benefited from the generative AI boom as a result of its scaled-up, purpose-built cloud infrastructure. In order to develop clusters to support AI workload, it has collaborations with cloud providers and AI companies with whom it also competes.

The company has exclusive access to the most cutting-edge Nvidia chips, which are in short supply. This gives it an advantage over other traditional cloud providers like Microsoft, Amazon, and Google, which are attempting to create their own chips while suffering supply constraints.

The additional funding will be used, according to the company, to hire more people, invest in data centers, and buy more graphics processing units. Last week launched a $1.6 billion data center in Texas and plans to open 14 more by the end of the year.

Additionally, CoreWeave raised $421 million in equity this year, with Magnetar Capital serving as the lead investor.