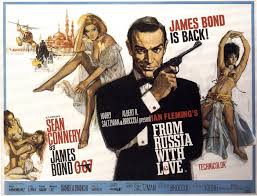

Amazon.com Inc said on Wednesday it is purchasing MGM, the legendary U.S. film studio home to the James Bond establishment, for $8.45 billion, giving it an enormous library of movies and Television programs and increase rivalry with streaming opponents led by Netflix and Disney+.

Privately owned MGM, or Metro Goldwyn Mayer, was established in 1924, possesses the Epix link channel and makes well known Programs including “Fargo”, “Vikings” and “Shark Tank.”

The deal is intended to assist Amazon with supercharging its Amazon Prime Video service by keeping clients engaged and paying a yearly membership that additionally ensures fast delivery of purchases from its online store.

“The real financial valuation behind this deal is the treasure trove of (intellectual property) that we plan to reconsider and foster along with MGM’s capable group. It’s extremely energizing and gives such countless freedoms to top notch narrating,” said Mike Hopkins, senior VP of Prime Video and Amazon Studios.

Amazon’s Superb Video faces an extensive rundown of contenders including Netflix Inc Walt Disney Co’s Disney+ HBO Max and Apple Inc’s Apple TV+. The organizations are expanding spending and growing in global business sectors, intending to capture the pandemic-driven shift to marathon watching shows on the internet.

Amazon has additionally made big bets pursuing fanatics of live games and has gotten rewarding licenses to stream games, including a long term deal to manage the National league that was assessed to cost about $1 billion every year.

The multiplying web-based features are additionally scrambling for brands that they can grow and libraries of more established shows and motion pictures. Analysts have said this is a major inspiration for another round of combination of media properties after a concise break during the pandemic.

Highlighting the pattern, AT&T Inc declared a $43-billion deal a week ago to turn out its WarnerMedia business and consolidate it with Discovery Inc perhaps the most goal-oriented at this point in the streaming period.

“Amazon is looking to turn into a more conspicuous part in the amusement world, and there could be no more excellent approach to do that than by getting perhaps the most iconic film studios in Hollywood,” said Jesse Cohen, senior expert at Investing.com. “It’s about content as the streaming conflict warms up.”

The acquisition is Amazon’s second-biggest after Whole Food Market, which it purchased for $13.7 billion in 2017.

The price represents an elevated premium compared with other deals. The prices is around 37 times MGM’s 2021 assessed EBITDA, or triple the enterprise value- to-EBITDA multiple that Discovery’s deal suggested for AT&T’s content assets. MGM began a conventional deal measure in December, when it was assessed to be worth about $5.5 billion.

The deal can be seen as a doubling down on business procedure that Jeff Bezos, Amazon’s President, explained at a meeting in 2016: “When we win a Golden Globe, it assists us with selling more shoes,” he had said, alluding to Amazon’s different business divisions.

In April, Amazon posted its fourth sequential record quarterly profit and flaunted in excess of 200 million Prime loyalty subscribers.

Amazon shares rose 0.3% in early trading.

Worthwhile Loyalty RIGHTS

Amazon has gotten Academy Awards over the years and gradually moved from craftsmanship house charge toward content with more extensive allure. The MGM acquisition speeds up that move giving it rights to James Bond, perhaps the most rewarding franchises, in film history that earned almost $7 billion at the box office globally, as per MGM.

MGM additionally has a gigantic library of exemplary movies including “Rocky,” “Moonstruck,” and “The Silence of the Lambs.”

The possibility to mine this intellectual property, by making new shows and movies dependent on mainstream characters, will help Amazon attract watchers to Prime, two previous Amazon executives said.

In any case, efforts by Amazon to profit off MGM’s library will not be simple, or modest.

Much of the time, MGM’s content is restricted by multi-year deals with television networks, the former Amazon executives said. Amazon can’t air MGM’s unscripted TV drama “The Voice,” for example, which authoritatively is in the possession of NBC.

Bringing another portion of the James Bond adventure to Prime watchers might be an especially troublesome assignment, the sources said. The terms under which MGM gained the franchise leave control in the possession of the Broccoli family, the Bond movies’ makers.

Information on the acquisition followed rapidly the return of Jeff Blackburn, Amazon’s former senior VP overseeing contents and M&A, who had left early this year.

Incoming Amazon CEO Andy Jassy had specific trust in Blackburn after a long time at Amazon together, trusting he’d shepherd a complicated consolidation, the sources said.