The IMF launched formal negotiations with Zambia for a loan to help service $12bn in external debts on Thursday.

Three weeks of virtual talks will revolve around extending a credit facility to Zambia, which became the first African nation to slide into default since the pandemic after missing a coupon payment on a $42.5m Eurobond.

In order to consider a sustainable program, the IMF will want to know the extent and composition of the country’s debt, including sovereign debt and state-owned enterprise debt, says Eric Olander, co-founder and managing editor of the China Africa Project.

“It’s all going to come down to transparency. If the Chinese are upfront about their loan portfolio in Zambia then it will ease the pressure on private creditors and the IMF to act, but so long as they all think that any debt relief will be used to repay the Chinese, then it’s hard to see that any meaningful progress will be made in these upcoming talks.”

Lusaka applied to the IMF for a bailout package in December at a time when its debt load was 120% of its GDP. This month, Zambia also requested a debt restructuring under the G20’s new common framework designed to tackle unsustainable debt.

The copper producer owes $3bn in outstanding Eurobonds, $3.5bn in bilateral debt, $2.1bn to multilaterals and $2.9bn to other commercial lenders, according to Reuters.

In addition, Zambia owes around $3bn to Chinese state-owned and private lenders, accounting for more than 25% of the total debt load, according to S&P Global Ratings Services.

The Economic Intelligence Unit estimates that Zambia spends almost half of its tax revenues servicing its debt. Beijing may agree to longer debt repayment moratoriums, ast the country did in Angola and recently in Kenya, Olander says. Beijing may also be open to a debt-for-equity swap as seen in Laos last year, but that is politically sensitive in Zambia given “debt trap” narratives, Olander adds.

“The Chinese have shown no indication that they’re willing to accept any debt cancellations in Zambia, or elsewhere on the continent beyond the modest cancellations of the zero-interest loans they’ve already agreed to. I think it would be futile to make any firm prediction as to what’s going to happen.”

Copper collateral?

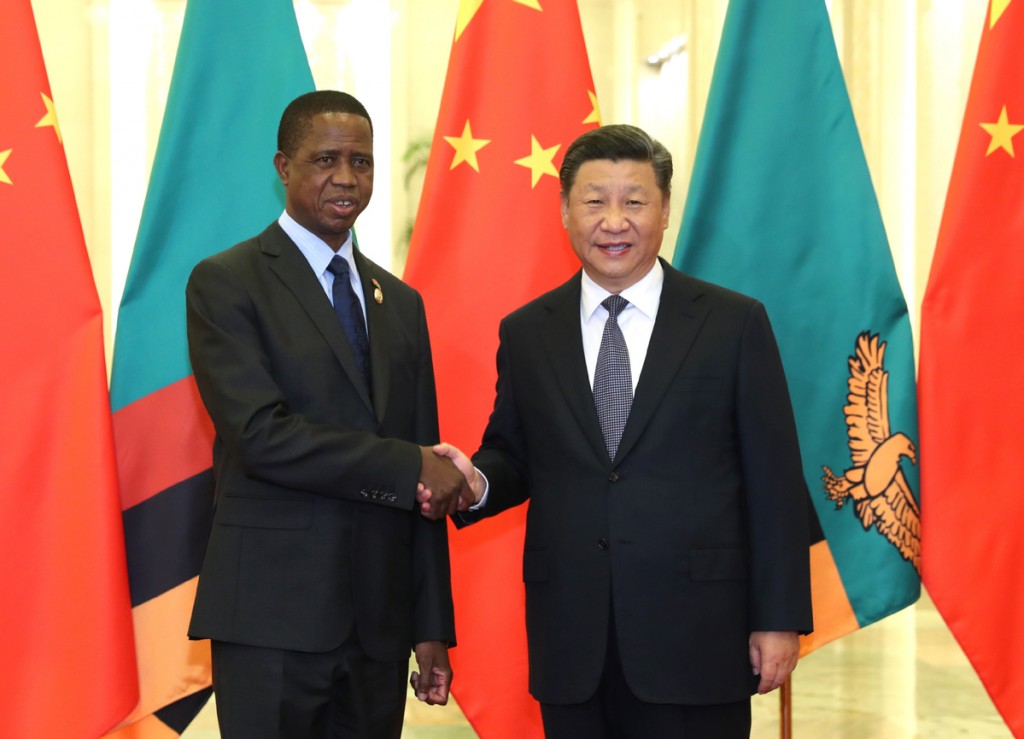

With President Edgar Lungu eyeing a re-election in August, the state mining investment firm ZCCM-IH recently purchased the Mopani Copper Mines.

The deal saw Lusaka take on another $1.5bn funded by debt to offset the loss of 15,000 jobs in the copper belt.

The IMF and World Bank estimate that around $10bn in undisclosed loans is owed to Chinese firms for infrastructure, with speculation that the underlying assets could be used as collateral. While speculation that defaults and restructuring of Chinese debt could result in Chinese takeover of major public assets, including roads, airports and mines, is exaggerated, it should still not be dismissed, says researchers at Chr. Michelsen Institute, a Norway based independent development research institute.

“Zambia needs to be much more careful in managing its economy and should avoid further irresponsible commitments to escape the more dramatic outcomes of major defaults, whether this affects the Chinese or the non-Chinese creditors.”

ALL AFRICA NEWS