Following a report in the investigative journalism publication ProPublica that prompted a U.S. senator to question Microsoft and led Defense Secretary Pete Hegseth to order

Category: WORLD NEWS

Stablecoin framework becomes the first US law in a big win for the digital assets industry.

A day after President Donald Trump stepped in to save the project, the Republican-controlled U.S. House of Representatives cleared significant procedural obstacles on crypto legislation

Meta investors face off against Zuckerberg in $8 billion trial over alleged privacy violations.

Wednesday marks the beginning of an $8 billion trial by Meta Platforms against Mark Zuckerberg and other current and former company executives for allegedly unlawfully

BoE delays the Basel Bank Trading Rule to 2028 in alignment with the US and global jurisdictions.

BoE delays the Basel Bank Trading Rule to 2028 in alignment with the US and global jurisdictions. A crucial component of new international regulations controlling

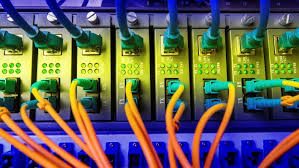

UK-based CityFibre raises $3 billion for broadband push to 8 million homes.

On Monday, the British fiber broadband company CityFibre said that it has secured 2.26 billion pounds ($3.04 billion) in fresh funding from its current lenders

US Black Friday online spending rises by $24.1 billion as sales are boosted by hefty discounts.

As eager buyers hurried to take advantage of steep discounts on back-to-school necessities, online spending surged $24.1 billion across U.S. merchants during the July 8–11

European securities watchdog warns about crypto companies deceiving their clients.

In the most recent indication that European authorities are attempting to reduce the risks associated with cryptocurrencies, Europe’s securities regulator cautioned cryptocurrency companies on Friday

Bitcoin reaches a record high ever, just below $112,000.

As conventional financial market participants adopted the largest cryptocurrency in the world, Bitcoin surged to an all-time high close to $112,000 late on Wednesday, supported

ECB warns about risks that extend beyond tariffs, including global capital flows and security concerns.

When evaluating the global environment, the European Central Bank will take into account risks that go beyond trade tariffs, such as security issues and possible

Nvidia-backed CoreWeave to acquire crypto miner Core Scientific in $9 billion all-stock deal

As AI infrastructure companies scramble to obtain power supplies to support their soaring workloads, CoreWeave will purchase cryptocurrency miner Core Scientific in an all-stock deal